Flowis integrates seamlessly with external systems to enhance supplier data accuracy and simplify supplier management.

How It Works

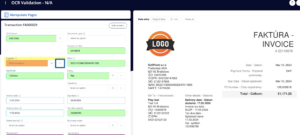

This integration proves invaluable during manual validation. When encountering an invoice from a supplier not yet created in Flowis, simply click the “+” at the end of the row to create such a supplier.

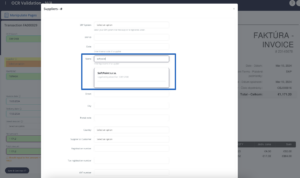

Enter the supplier’s name, registration number, or VAT number and choose desired supplier from the list.

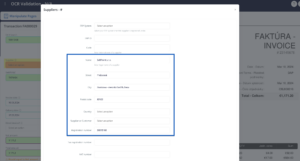

The system will automatically populate the remaining details using data from the Register of Legal Entities – name, registration number, address, VAT number, and tax registration number; and IBAN from Financial Administration.

Additionally, once the VAT number is entered, it is validated against the VIES database.

Setting Up Supplier Integration

To configure this feature to your Flowis instance, follow these steps:

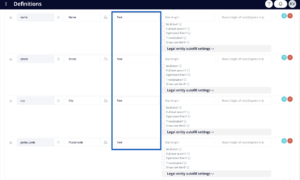

1. Navigate to Suppliers list in Codelist Definitions: Ensure that all searchable supplier data fields (name, registration number, street, city, postal code, VAT number, tax registration number) are set to the Text Data Type.

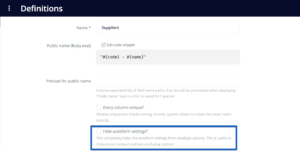

2. Enable Legal Entity Autofill: Make sure you have the autoform settings shown. Then open the “Legal entity autofill settings” dropdown and check the “Use as legal entity search field?” box. Select the appropriate column from the legal entity table to map this field (do not forget to do so for every column you need to map). This setup allows the system to prefill legal entity data in forms.

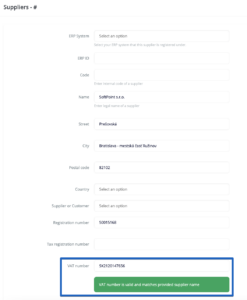

3. VAT Number Validation with VIES: To enable VAT number validation, check the “VIES Validate VAT” box.

This validation process can result in four outcomes:

- VAT number is valid and matches the selected supplier.

- VAT number is valid but does not match the selected supplier.

- VAT number is invalid.

- The VIES validation service is unavailable.

Leveraging Flowis’s integration capabilities ensures your supplier data is accurate and up-to-date, facilitating smoother operations and reducing manual entry errors. By following these setup steps, you can optimize your supplier management process and ensure compliance with relevant tax validation requirements. In addition, you can use the same setting for the list of Entities.